-

Investing defined

-

All about Investment

-

Guidelines to right investment

-

Myths about investing

-

HOW CAN WE BE A HELP?

-

Do's and Don'ts

What is meant by investment?

We all save money or at least try to do so. But keeping your money idle is like keeping it asleep. In order to take some advantage over the returns on your regular savings, you need to put it in some activity or venture that will give you more returns than just keeping your money idle. Hence, Investment is an outcome of your efforts to save for your future.

Investment helps you meet your longer term needs and financial goals. There is some level of risk attached to all types of investments and this is what determines the returns on your investments. The higher the risk, the greater the chances of a higher return. To start investing, you can take up investing ventures that carry less risk and give you decent returns.

Why should I Invest if I am already saving?

It's heartening to note that you save. But by just saving, you are neglecting the fact that there are several other factors that affect your savings namely inflation, changes in Interest rates, changes in government and monetary policies etc. They can eat away your savings easily and thus plain saving doesn’t serve the purpose to protect yourself and your future against such uncertainties. That's why you require the professional help.

Why not look out for some venture where your money is safe and is able to earn more than your usual saving at the same time. Investing regularly and over a period of time also helps you to take advantage of the compounding factor.

When & how do I start investing?

It is always recommended and favorable to invest at young age in order to reap the benefits of compounding and staying invested for long. To start investing, you need to first understand your current financial situation and your future financial goals. In order to understand the same and analyze your situation, get a professional to help you profile your needs and suggest a suitable investment plan for you. Once you have outlined your future financial goals, you can start planning for financing your investment plans. In the initial stages, you can start investments in Fixed Deposits, Mutual Fund, Stocks and Bonds etc. Before you make investments in any of the investment avenues, make sure you have understood the rules and regulations of such investment.

You can take a slow start but a steady one will always benefit you. Hence, be regular in your investment and don’t take up investments that have a lot of risk involved as this may prove unrewarding for your investment plan.

How much should I invest?

Though every investment instrument has a certain minimum invest able amount, there is no such fixed amount that one should invest in order to generate X amount of returns from it. The amount that you should invest will be dependent on the following facts –

- How much of liquid money do you have which can be invested right away?

- What are your future financial goals?

- The time horizon that you foresee to achieve your financial goals

- What is your risk taking capacity etc.

How long should I stay invested?

There is an optimum period of time that one should stay invested in any investment instrument but it is more dependent on personnel attributes such as your age, Financial Goals, time horizon, life cycle of the instrument earnings, economic conditions, interest rates etc. e.g. If you have invested in a top performing instrument which is at its peak performance, there is no point in staying invested for a very long time as it is more likely to start shedding off the profits as the time passes by. Same way, if you have started investing at young age, you can stay invested for a longer period of time than an old person.

What kind of investment avenues can I look forward to invest?

Once you have decided to invest, you can look at Stocks, Bonds and Fixed deposits, Certificate of Deposits, Mutual Funds to invest in and also keep track of which investment is more profitable as compared to others.

Are there any information sources I can rely on, to make my investment decisions?

With more and more people investing, there is wide spread availability of information on every kind of investment through print media, television, radio, SMS, internet etc. Though there are a lot of information sources available, not all of them prove to be true for everybody. So, you need to first verify the authenticity of the source, their reliability and how good they are at it in order to trust them with your investments. One of the reliable information sources is your broker or investment consultant who would suggest you a solution that suits your profile.

What is diversification?

Diversification is the process of investing into different investment instruments which are different from each other in terms of their functionality, the risk and rewards involved, rate of return, factors that affect their performance etc. Though Diversification doesn’t guarantee better performance and cannot protect your portfolio from losses, it surely helps to alleviate some of the speculation that is involved with investing in one single instrument.

What is the importance of diversification?

It is important to diversify your portfolio in order to maintain a disciplined investment strategy that can sustain in longer run of time. It also helps to maintain an appropriate level of risk in the portfolio rather than making it completely exposed to risk. Diversified portfolios tend to stay robust even in adverse circumstances while a portfolio which is more concentrated on a specific sector or type of investment instrument. It keeps your portfolio from suffering in adverse times and makes it very robust in positive times.

How long should I stay invested?

There is an optimum period of time that one should stay invested in any investment instrument but it is more dependent on personnel attributes such as your age, Financial Goals, time horizon, life cycle of the instrument earnings, economic conditions, interest rates etc. e.g. If you have invested in a top performing instrument which is at its peak performance, there is no point in staying invested for a very long time as it is more likely to start shedding off the profits as the time passes by. Same way, if you have started investing at young age, you can stay invested for a longer period of time than an old person.

What kind of investment avenues can I look forward to invest?

Once you have decided to invest, you can look at Stocks, Bonds and Fixed deposits, Certificate of Deposits, Mutual Funds to invest in and also keep track of which investment is more profitable as compared to others.

Are there any information sources I can rely onto make my investment decisions?

With more and more people investing, there is wide spread availability of information on every kind of investment through print media, television, radio, SMS, internet etc. Though there are a lot of information sources available, not all of them prove to be true for everybody. So, you need to first verify the authenticity of the source, their reliability and how good they are at it in order to trust them with your investments. One of the reliable information sources is your broker or investment consultant who would suggest you a solution that suits your profile

What is diversification?

Diversification is the process of investing into different investment instruments which are different from each other in terms of their functionality, the risk and rewards involved, rate of return, factors that affect their performance etc. Though Diversification doesn’t guarantee better performance and cannot protect your portfolio from losses, it surely helps to alleviate some of the speculation that is involved with investing in one single instrument.

What is the importance of diversification?

It is important to diversify your portfolio in order to maintain a disciplined investment strategy that can sustain in longer run of time. It also helps to maintain an appropriate level of risk in the portfolio rather than making it completely exposed to risk. Diversified portfolios tend to stay robust even in adverse circumstances while a portfolio which is more concentrated on a specific sector or type of investment instrument. It keeps your portfolio from suffering in adverse times and makes it very robust in positive times.

Have some investment goals

It is of utmost importance that you have some realistic investment goals otherwise just investing blindly into any instrument doesn’t serve the purpose of investing nor does it helps you prepare for a better future. Before you start investing, think over what do you wish to achieve from your investments, why do you want to invest. Unless you are clear on the same, investing just because somebody else is doing it; doesn’t helps you reach anywhere.

Have a pre planned time horizon for investing your money

When you start investing, you should also have a certain timeline in mind which will fetch you the kind of returns you are expecting to generate from the investment. Nothing happens overnight, if you wish to create wealth, achieve your financial goals, then you also need to find a timeline in which you can achieve it. This timeline again varies from person to person depending upon their current financial situation and risk taking capability. Your time horizon for investing could depend on the number of years after which you aim to provide for your daughter's higher education or her marriage etc.

Always keep your liquidity requirements in mind

Nobody else knows about your financial requirements better than yourself. While taking any decision on investments, always keep your liquidity requirements in mind so that you don’t end up tying your money for future only with nothing available for your present. Before you invest, analyze the time period for which your money is tied up and not readily available. Once you have done that, you can decide as to how much money would you like to invest and how much to remain with you as liquid funds.

Investment requires big sum of money

It is a wide spread myth that to start investing, you need big sum of money; if you don’t have big money, you can’t investing. It is completely baseless to say so. With the evolution of economic freedom and wider reach of financial services, the ease of investing has improved tremendously which allows you to invest in small amounts. You can start investing even with a sum of Rs. 1000 a month by investing in Mutual Fund. But remember to keep investing regularly though in small amounts as after a certain time period, it will fetch you the benefits of compounding which will become a good investment portfolio. So, start investing right away instead of wasting time just getting caught up in the rumors.

There is a certain age limit to which I can invest

It is not completely true for all as it has its own limitations. You can keep investing till any age you desire to but it is always advised to start investing at an early age. The earlier you start, the better it is for you to be able to reap the benefits of compounding the earnings on your investment. Before you start investing, consult a professional to help you decide on the same depending on your current financial situation, your future financial goals and your age.

You can start your investments, through us by either calling us, sending an email, registering online with us allowing us to get in touch with you. With a vast experience in Financial Services and the wide range of services that we offer, who else can help you to plan & start your investments better than us.

We will guide you through the process of investing and help you to start your investments based on your individual financial requirements. Get the experts talking to you and address to your queries directly.

Start investing at an early age (added advantage)

If you are young, can save some money; then put it to work better for you than just lying idle in a bank account, earning meager amount of interest. If your start investing in early ages, you will not only have a good portfolio size to enjoy the returns of compounding in later stages of your life but also would have mastered the art and science of investing and achieve your financial goals though it.

Get professional help to plan and start your investment

Along with starting early investments, it is equally important to seek advice from a professional to guide your investments in to a better way and to help you structure your portfolio. You can either consult a financial service provider or broker who provides third party products.

Learn about your present and future financial requirements

It is of utmost importance that before you start your investments, you should be able to understand your present financial situation and your future financial goals that you wish to achieve. Once you are clear with these, you can identify the investment opportunities applicable in your case and then decide on whether you can go ahead with the investment plan.

Find out the list of investment options available and zero down on the ones that suit your requirements.

Once you are certain on starting your investments, look for the investment options available in the market and select some investment plan based on the same and invest in the best of them suitable to you.

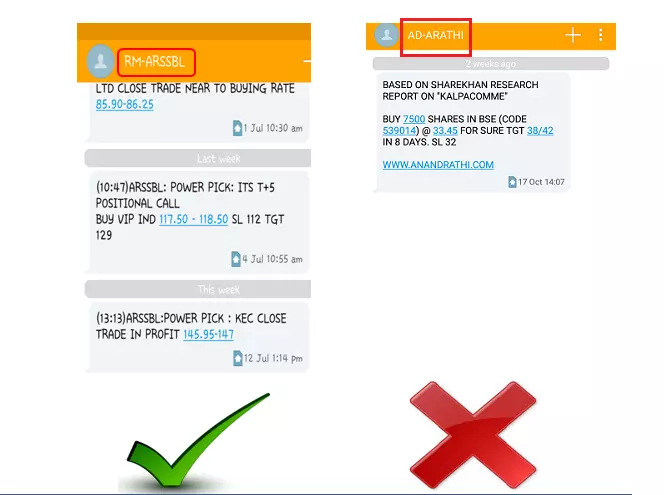

Don't rely on unknown or unqualified sources for your investment plan

When your investments are concerned, don't rely on unknown or unqualified sources to make your investment decisions. Don't trust any of your neighbor's or friend's hush rumors about any stock tip, even if you happen to come across any of them, don't lose a chance to verify their authenticity from a trusted professional.

Don't follow what others are doing

Most of the times, we get caught in the wave that others are riding; so don't just follow what others are doing since one opportunity cannot be good for all and you can be the odd one out. Hence, analyze an opportunity before you actually invest your money.

Don't put all your funds in one investment avenue

While making investments, don't put all that you have to invest in one instrument / sector alone as this would make your portfolio prone to sector specific uncertainties that may effects your portfolio valuation. If you distribute the total invest able amount in to various instruments, you would safe guard your portfolio from adverse affects of changes in one sector which would get absorbed by the profits in another sector.

-

Stock market introduction

-

CONCEPTS & TERMS YOU SHOULD BE FAMILIAR WITH

-

GUIDELINES TO EQUITY INVESTMENT FOR BEGINNERS

-

Do's and Don'ts

-

Basics of Equity Investment

-

Investment Follow up

-

Some tips to Equity investing

-

Myths about Equity Investment

-

Dos and Don'ts

-

Equity Investment in depth

What is meant by stock market?

A stock market is a private / public market where securities of companies and their derivatives are traded at a predefined / agreed price. Usually these securities are listed on stock exchanges. A stock market consists of few stock exchanges where the listing and trading takes place. All stock markets are regulated by some organization designated by the Govt.

How does a stock market function?

A stock market has many members who co ordinate for various activities in the process of placing orders, their execution and settlement etc. A person who desires to buy / sell shares in the stock market, can place his order through the broker either in the traditional manner or can place an online order himself through the terminal provided by the broker.

When an order is placed, the order is sent to the exchange and then the order resides in the Exchange system till all conditions of the order have been met with. When the conditions of the order are fulfilled, the order is executed and the shares purchased / sold are delivered to the buyer / obtained from seller through the broker. The whole settlement process takes place through NSCCL (National Securities Clearing Corporation Limited), the official clearing agent for the stock market in India.

Who regulates the stock market?

In India, the stock markets are regulated by SEBI (Securities and Exchange Board of India). There are several stock exchanges in the country out of which the two most prominent exchanges are BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The signature index for BSE is Sensex while for NSE, it is NIFTY.

What is Rolling Settlement?

Rolling Settlement is the mechanism adapted by the Indian Stock markets for faster settlement of trades. In Rolling Settlement, trades executed during the day are settled on net obligations basis. In India, settlement of trades executed is done on T+2 basis where T stands for Trading day and +2 stands for two working days excluding the trade day. Net the effect of shares bought or sold is on the third day from trade day.

In this kind of settlement, two trading days are considered for settlement where Saturday, Sunday, Bank Holidays and trading holidays are not considered as working days for settlement. Hence, a trade done on Monday will get settled on Wednesday.

What is dematerialization?

Dematerialization is the process by which an investor can get the physical share certificates converted into electronic shares of equivalent number and value. Dematerialization takes place though a depository participant who assists an investor to get the shares dematerialized.

In this process, once the physical shares have been converted into electronic shares, they are credited to the client's demat account which is with the depository participant. An investor can get those shares dematerialized into his / her account only if those share certificates are registered on his / her name.

Margin trading

Margins are collected to safeguard against any adverse price movement and it is usually a percentage of the transaction value. In share trading, you can buy shares only up to the margin amount existing in your account. i.e. you cannot exceed your margin limit to place an order.

In order to take advantage of price movements, even though you don't have enough margin in your account, Margin trading has been introduced for the facility of investors. Margin Trading is a facility provided by a broker to the client where a client can place orders for a value exceeding the margin amount available in the account. In margin trading, a part of the required margin is given by the client while the rest is funded by the broker.

Different types of orders that can be placed

There are various types of orders that can be placed in equity investment; such orders have been listed below:

- Delivery order: Order where shares are delivered into the client's demat account for settlement and they cannot be sold on the same day of order placement. One can only sell such shares once their delivery has been received.

- Intra-day order: Order where shares are bought and sold on the same trading day and there is not delivery of shares into the client's demat account for settlement. For such orders, settlement is done on net payment basis where only monetary effects are given to the client's account.

- Market Order: An order placed at current market price of a share in order to get instant execution of the order. This order is placed when an investor expects the share price to rise sharply and is thus keen on buying it. Such orders may get executed at market price when your order is placed but there can be some difference in the price at which your order was executed as there could be a price change while you place your order.

- After Market Order: An order that can be placed to buy or sell a share even when the market session is over. Such orders are executed when the next market session opens for trading. After Market orders can be placed within a specific time period which varies between different brokers.

- Stop Loss Order: An order that allows you to decide the maximum loss that you are ready to bear in intra-day trading. As in intra-day trading, you enter and exit the position within the same trading session, Stop Loss order is placed to safe guard against potential losses that may occur once your order is executed.

Suppose you place a buy order at Rs.125 and it gets executed, in order to minimize the losses if any adverse price movement takes place; you need to place a reverse stop loss order. This order will be a sell order with the same quantity of stock that you have received as a result of the buy order. Now you need to specify the price at which you think you would like to exit the position which can be Rs. 120 and also the price at which your order should enter the market which can be Rs.123. This price (Rs.123) is called trigger price. If you think that the price may fall, from the current market price, then you can put this trigger in stop loss order to make sure that it enters the market only after the trigger price has been reached.

Circuit Filters

A circuit filter is a measure introduced by SEBI to determine fixed price bands for different securities within which they can move in a day. If there's any breach beyond / below these price bands, it will result in temporary halt in trading for those securities.

Circuit filters are based on the previous close price of the security and as previous close price of the same can be different on BSE and NSE; so can be the circuit filters.

Short selling:

The concept of short selling simply means selling a share that you don't own. In short selling, an investor sells a share that he / she doesn't own but is expecting the price of the same to decline.

It is generally practiced in intra-day trading & FNO trading where the sell position is covered by buying a stock so that the net monetary benefit gets affected in the account and no delivery of shares is required.

Auction of shares:

Auction of shares is a methodology adapted by the exchanges to make sure that the buyers get delivery of the shares due to them as a result of short delivery. Short delivery of shares generally takes place due to short selling by seller's who don't possess the required number of shares.

In this process, the exchange buys shares from the seller's broker who lends such shares to the seller and delivers it at an agreed price to the buyer. The seller in such case has to bear the monetary loss / expenses incurred in the auction.

Insider Trading:

Insider Trading is basically trading / investing in any particular security based on unpublished information which is price sensitive for that security. Usually such information comes from people who are associated with the source of such information and want to make profit from such information.

Insider trading is prohibited and an offense punishable by law.

Understand the rules and regulations of equity investment

Before you invest in equity, read through different information sources such as broker websites, articles available online regarding equity investment, newspapers, magazines etc. to get as much information about equity investment rules and regulations as possible.

This will equip you with information and you will be in a better position to take wiser decisions; also it will help you to avoid any mistakes that may take place due to lack of information on rules and regulations to be fulfilled.

Know about the different ways you can invest in Equity

As you start your investment in equity, you should also be updated with the latest news on the different ways you can invest, keep in touch with your investments, place your orders and get updates so that you don't miss out on an investment opportunity while you are on the move. For example, you can get quotes, place your orders, get market & your investment updates through Online, Email, Phone Call, Mobile Trading and SMS.

Why invest in shares?

Investing in shares is like investing into ownership of a company which no other investment instrument can give you. Unlike any other investment instrument which either give you fixed income or meager returns and no owned share in the same, equity investment gives you an opportunity to become a part of the company ownership and also gives you regular returns on your investment as dividend income or through price changes.

Investing in equity also allows you to enjoy the flexibility of staying invested as long as you wish to, take advantage of the price movements and thus utilize the liquidity. In an overall view, equity investment is better than any other investment.

Can I invest in any share?

By the virtue of investing in shares, you can invest into any share but since investing in equity is like owning a part of the company, you should be careful about which share are you investing your money. The profits that you earn from such investment will largely depend on the shares that you have purchased. If you have invested in a low earning share, no matter much you invest, it is not going to fetch you the same kind of return as a high earning share.

How do I buy / sell shares?

In order to buy / sell a share, you need to first become a client of one of the stock market members who are commonly known as stock brokers. But before you sign up with a stock broker / financial services provider, you need to understand the importance and sensitivity of the relationship between the stock broker and yourself so that you are familiar with the rules and regulations abiding in the relationship.

Once you have chosen your stock broker / financial services provider, you need to open an account with the same, get quotes for the share that you wish to buy and place orders either by calling up or online.

When am I ready to buy shares?

Before you put your money into shares, you need to be aware that investing in shares is not only rewarding but also risky so you need to make sure that the surplus money available with you at hand may not be required in near future. This is so because to reap the benefits of investing in shares, you need to stay invested for a considerable time period.

Once you are clear about the above mentioned facts, you are ready to buy your first share.

How much does a share cost?

The price of a share is preset by the exchange. The demand and supply factors of the market determine the price at which a share is bought or sold. A share can cost anywhere from less than Rs. 10 to an amount even above Rs. 2000.

If you are keen on buying a share of a company, you can either refer to any of the news papers that provide such information or find it online thorough online trading platforms provided by your broker or even calling up to your broker in order to assist you in the same.

Can I put all my surplus money in shares?

The answer to this is all dependent on your age, your financial requirements and future goals.

If you are young, surplus money at hand that is not likely to be required in near future, can stay invested for few years, then you can invest all that in shares.

But if you are retired / likely to retire soon / old, have no other source of income or earn meager income, surplus money at hand that is not likely to be required in near future, you should not resort to investing all that in shares, instead you can diversify your investments into bonds, fixed deposits, Govt. securities etc. and a lesser exposure in equity investment.

How to track the performance of your investment?

You can track the performance of your investments by either using the information available in news papers, online information, calling up your broker and if you are tech savvy you can do it through the portfolio tools provided by brokers to their clients which help you to track if your portfolio is in profit or loss and what could be the potential profit or loss as compared to the market sessions.

Portfolio review

You should not stick to the stocks you have invested in earlier times. As time passes by, there are a lot of factors that affect the performance of your stocks and thus can affect your portfolio valuation. If you wish to keep you portfolio in profits and free from non performing holdings, you need to review your portfolio on regular intervals to keep it updated with what’s in & out of the market and to get good returns from your investments.

Common mistakes an investor should avoid

- Panic Selling: In your investment tenure, an investor will come through a phase where the stock prices will go down for a while; this may cause panic and the split second decision people generally take is to sell out your holdings. You should not panic in trouble times and do as this could be detrimental to your portfolio valuation where you could be waiting for long to buy the stock again at lower prices when you discover that you’re selling out was baseless or just out of fears spreading from rumors. The key to successful investing is to stay invested and buy value stocks at their dips.

- Never Selling: There are times when your stocks are performing well and have the potential of giving you high returns but you still want to hold on to them in good belief that there are better days to come and earn you can earn more than this opportunity. Make your decision to sell your stock based on the fact of how good is the scope for more price hike. Also, you need to consider that this might be your chance to make profits rather than just holding on to the stock.

- Investing in Cheap Stocks: We often come across situations where there is lot of volatility in a cheap stock and giving many people opportunity to make profits out of the rapid price movements. Before investing in such stocks, you need to consider the fundamental reason supporting such price movement. Investing in cheap stocks can be risky because there can be situations where you can be the last person to enter in that stock buying spree but you are stuck with that stock later as they have started to tumble down and are usually not potentially strong stocks.

Kind of stocks one should pick to invest.

There are certain criteria’s that act as a base for any stock investment decision such as the targeted time frame for staying invested, kind of stocks one wishes to buy, intention behind buying a stock etc. Ideally if you are looking to invest for long term, you should go for stocks that are fundamentally strong, have good performance record, good management and potentially strong plans for future earnings.

But if you are looking to invest in stocks just to make money in short term, you can buy buzzing stocks that are performing good, have good market recognition and have their technical’s in place and are considered as good stock pick by most of the investors.

Entry and exit timing

Whenever you take a decision of investing in to a stock, try to analyze the life cycle of the stock’s performance and judge it against your entry timing into buying the stock. If a stock is at its lifetime high and still performing, you should probably not invest in the same at this time as it has already reached the peak of its performance life cycle after which there are few chances that it will continues to perform good in near future.

If you have invested in stock that as achieved its life time highs and has started to show the sign of coming down from the peak, you should probably exit from the position in such stock as it may keep coming down to unfavorable levels for your portfolio. Hence, it is very important that you analyze the time of entry and exit into any stock investment.

Equity Investment is a short term investment plan

It is a wide spread myth that equity investment is a short term investment plan. Though it can be true when markets are at all time high levels, it is still held good that equity investment is not a short term investment plan, it requires time and the patience to stay invested and one cannot reap true benefits of equity investment in short term.

There is sure shot possibility of making losses in Equity Investment

As always maintained, equity investment is as risky as it is rewarding for its investors. You don't make profits or losses in equity investment all the time. As everything else in life, it has its good and bad times which affect your investments but it is not true that equity investment is a sure shot way to make losses.

If you have invested wisely and with caution, you are less likely make any losses than somebody who has invested in an ad hoc manner.

Equity is not a good option for investment

Because of the ever changing behavior of the stock markets, most people consider equity investment as an unsafe option as compared to other investments which give you fixed income returns and carry less risk. However, if observed closely equity investments give you the best returns in good times & these are generally higher than what other fixed income investments can give you. Hence, you can see that equity is a good option for investment if you want more returns on your investments than just a fixed amount of return

Study the market direction

If you have been investing regularly and following the market closely, you would have observed that there are times when you can predict the market direction in near future. If you have slightest of clue as to which direction is the market headed; you can enter or exit the market accordingly and take better decisions about your investment in equity.

Evaluate an investment opportunity before you actually invest

Before you invest your money in any stock, evaluate it as an investment opportunity with its risk and reward potentials. Analyze the impact such investment on your portfolio valuation, how long you may have to hold it and how good do your find it for investment.

Don’t ignore the caution signals

In equity investment, there are times when you get skeptical about the market movement in near future and these are indicated throughout the trading sessions. These are called caution signals that are to be observed and adhered to when you come across them. If you have noticed anything adverse about the market behavior, gather information about the same through the sources available and take necessary steps to shield you portfolio against the adversities.

Don’t get married to stocks in your portfolio

In order to take advantage of the price movements, you need to track the valuation of your investments and take necessary action to earn profits out of it.

Investing in equity is all about striking at the right opportunity. If you get attached to the stocks in your portfolio and don't sell them off at the right time, you are just going to keep them in your portfolio for ever and make no profits out of it.

Buying extremely volatile stocks

If you want to make quick money out of equity investment, you may follow the stock tips that you get to hear from different sources and make money; but at the same time, it is essential that you also consider the risk involved in such investments as there can be a possibility of you making more losses than you actually thought which might not be favorable to your risk taking profile. Investing in extremely volatile stocks is short lived and you may end up regretting over the investment idea if you aren't prepared to for it.

What is the difference between Growth and Value stocks?

Growth stocks are basically stocks that have been there for a good number of years in their business, have performed well earlier and have excellent potential for growth of their business and earning in future.

Companies that have focus on what they are into and have some big plans for the future, have good management and are growing faster than other stocks from the same industry are termed as Growth stocks. These companies usually don’t pay much of dividend; they rather believe in reinvesting the same in business to generate more revenue. These stocks are meant to hold for long period of time to reap the benefits of long term investing.

Value Stocks are stocks which are not sought after by most of the investors but they may have good earning potential which are yet hidden in current scenario. These stocks may have had a bad fall in the price, or may belong to an industry that doesn’t has a good performance record but it still has its fundamentals strong and has potential to improve. Once the volumes in such stocks start to pick up, their price rise is eminent and thus proves to be value picks.

How to identify a good investment pick?

When you think of buying a stock, you must have some clarity as to why you are buying it, what advantages does the stock carry over others etc. Before you decide to buy a stock, do you own study on the stock as an investment opportunity, whether it is a growth or value stock, how is the company performing as compared to its peer group in the same industry and performance against the whole industry.

If the company is performing at par with others in the same industry, try to find out about its management and whether they have some credentials to their benefit which are added advantage over the rest. Then gather information as to the kind of stock it is – growth or value. Try to compare the performance of corresponding industry and the company to check if the company’s performance is in line with that of the industry. If these criteria’s are met according to your expectation, it can prove to be a good investment pick.

How to minimize the risk involved in Equity investment? (Diversify)

Though there is no sure shot solution to the risk involved in Equity investment but there are a few ways which can help you minimize it.

Diversify: One of the smartest ways to minimize the risk involved in Equity investment is to diversify your investment portfolio. Ever since you start your investment, you can invest in stocks from different industry and business operation cycles instead of concentrating on one single category / industry.

Hedging: You can also hedge your portfolio holdings against potential adversities by investing in Futures and Options (FNO) of the stocks in holding. By hedging your holdings in FNO, you can earn profits in FNO trading while the valuation of your holdings is going for a dip. This way, you nullify the negative impact of adversities on your portfolio.

Stay updated: At times being up to date with latest information about companies can come to your benefit as you can enter or exit into a stock position according to the potential impact of the news on your holdings or the earning potential of the stock.

-

Introduction to Mutual Fund investment

-

Concepts & Terms you should be familiar with

-

Investing in Mutual Funds

-

Taxation and Charges

-

Guidelines to Mutual Fund Investments

-

Mutual Fund investment in depth

-

Some tips to invest in Mutual Funds

-

Myths about Mutual Fund investments

-

Do's and Don'ts

What is a Mutual Fund?

A Mutual Fund is a professionally managed collective investment that pools money from many investors and invests the same in stocks, bonds, short-term money market instruments and other securities.

The mutual fund itself is a trust registered under the Indian Trust Act, and is initiated by a sponsor. The sponsor then appoints an asset management company (AMC) to manage the investment, marketing, accounting and other functions pertaining to the fund.

Every mutual fund has a fund manager who invests the money collected through subscription from different investors on behalf of the investors by buying / selling stocks, bonds etc. Various funds and schemes with different objectives can be introduced under the umbrella of a single Trust name.

What is an AMC?

The word AMC stands for Asset Management Company. An AMC is a company that runs and manages mutual funds. It is a company appointed by the trustees to manage the investor’s money for which the AMC charges a fee but the same is borne by the investor’s as it is deducted from the money collected from them.

Every AMC has to be approved by SEBI in order to manage a mutual fund. It is the AMC, which introduces new schemes and manages their operations in the name of the Trust. An AMC follows the rules and regulations laid down by SEBI and the terms of the agreement between Trustees and AMC. An AMC is responsible for preparing the Offer Document or schemes / funds floated under the Trust's name. The AMC also has the authority to appoint intermediaries for distribution of the funds / schemes floated by it.

Who regulates the AMCs?

All Mutual Funds in India are governed by SEBI under the 1996 Mutual Fund Regulation.

How do mutual funds operate?

Mutual Funds in India follow a 3-tier structure. There is a Sponsor (the First tier), who thinks of starting a mutual fund. The Sponsor approaches the Securities & Exchange Board of India (SEBI), which is the market regulator and also the regulator for mutual funds.

On the checks performed by SEBI for integrity, experience in the financial sector and net worth, the sponsor can create a Public Trust as per the Indian Trusts Act, 1882. (Second Tier).

Trusts have no legal identity in India and cannot enter into contracts, hence the Trustees are the people authorized to act on behalf of the Trust. Contracts are entered into in the name of the Trustees.

Once the Trust is created, it is registered with SEBI after which this trust is known as the mutual fund. The Sponsor and the Trust are two different identities. It is the Trust which is the Mutual Fund.

The trust then appoints an Asset Management Company (AMC) that manages the investment of funds collected from different individual investors. (Third Tier)

Why invest in Mutual Fund?

Direct investment in shares requires investment of money and time in order to find out good, performing stocks, understanding their current financial strengths and future earning potential etc. One needs to do a lot of research before you invest which is quite cumbersome and time consuming for a lot of investors.

Investing in Mutual Fund is a lot easier for many investors as the responsibility to invest in stocks and other instruments is taken over by the AMC which takes a decision to invest after due diligence, research and analysis. One can leave the decision to utilize the funds on professional fund managers of the fund.

Mutual Fund investment also offers diversification of portfolio holdings. An investor’s money is invested by the mutual fund in a variety of shares, bonds and other securities thus diversifying the investor’s portfolio across different companies and sectors. This diversification helps in reducing the overall risk of the portfolio.

Also it is more economic to invest in a mutual fund since the minimum investment amount in mutual fund units is fairly low (Rs. 1000 or so). With Rs. 1000 an investor may be able to buy only a few stocks but not the desired diversification.

What are the advantages of investing in Mutual Fund over Equity?

Mutual Funds give investors best of both the worlds. Investor’s money is managed by professional fund managers and the money is invested in a diversified portfolio.

- Small investors cannot buy a diversified portfolio by investing in small amounts in direct equity investment but if they invest in a mutual fund, they can own such a portfolio.

- Mutual Funds help to reap the benefit of returns by a portfolio spread across a wide spectrum of companies with small investments.

- Time is a big constraint and all investors may not have the expertise to read and analyze balance sheets, annual reports, research reports etc. A mutual fund does this for investors as fund managers, assisted by research analysts have the resources to do such a detailed research and invest according to their research results.

- Investors can enter / exit schemes anytime they want (in open ended schemes). They can invest through SIP, where every month, a stipulated amount automatically goes out of their savings account into a scheme of their choice. Such hassle free arrangement is not available in case of direct investing in shares.

- As more and more AMCs keep coming in the market, investors will continue to get newer products and as a result of competition, costs will be kept at minimum levels. Initially when mutual fund investment was a novice, mutual funds could invest only in debt and equities.

Then they were allowed to invest in derivative instruments also. As an ever evolving phenomenon, AMCs kept introducing various investments in different, non conventional instruments such as Gold ETFs, investing in international securities and real estate mutual funds.

It is better for the investor’s to have a wide array of investment opportunity with minimum investment on regular basis. - Mutual funds are for all kinds of investors. Investors can either invest with the objective of getting capital appreciation or regular dividends. Young investors who have regular monthly income would prefer to invest for the long term to meet various goals and thus opt for capital appreciation (growth or dividend reinvestment options), whereas retired individuals, who have a long saved kitty with them and need a monthly income, would like to invest with the objective of getting a regular income.

- Mutual Funds regularly provide investors with information on the value of their investments. Mutual Funds also provide complete portfolio disclosure of the investments made by various schemes and also the proportion invested in each asset type.

- All the Mutual Funds are registered with SEBI and they function within the provisions of strict regulation designed to protect the interests of the investor.

How much is required to invest in mutual fund?

There is no fixed amount of money that one should invest in Mutual Funds either through SIP or Lump Sum investment options. However there is a minimum requirement of Rs. 1000 to be invested for Mutual Fund investment through SIP. It makes more sense to invest in pretty good amount if you are opting for lump sum investment

What are the different types of Mutual Funds available for investment?

There are various types of funds available for investment in Mutual Funds. They can be broadly classified according to their Investment Objectives, scheme structure and special schemes. A few of them have been listed below:

Investment Objectives

- Growth Funds

These funds have capital appreciation as their primary goals and dividend pay outs as secondary goal. They invest in well established companies where the company and the industry in which it operates are perceived to have good long-term growth potential.

These funds generally incur higher risks than income funds in an effort to secure more pronounced growth. These funds can be concentrated on one sector or industry or a group of industries and sectors. These funds are suitable for investors who can take some risk on the valuation of their investments to get rapid gains but not for investors who must save their principal and need to earn maximum current income rather than awaiting for earning income in future.

- Growth and Income Funds

Growth and income funds seek long-term growth of capital as well as current income. Some invest in a dual portfolio consisting of growth stocks and income stocks, or a combination of growth stocks, stocks paying high dividends, preferred stocks, convertible securities or fixed-income securities such as corporate bonds and money market instruments. Others may invest in growth stocks and earn current income by selling covered call options on their portfolio stocks.

Growth and income funds have low to moderate stability of principal and moderate potential for current income and growth. They are suitable for investors who can assume some risk to achieve growth of capital but who also want to maintain a moderate level of current income.

- Fixed-Income Funds

Fixed income fund's primary goal is to provide consistent current income with preservation of capital. These funds invest in corporate bonds or government-backed mortgage securities that have a fixed rate of return.

High-yield funds, which seek to maximize yield by investing in lower-rated bonds of longer maturities, entail less stability of principal than fixed-income funds that invest in higher-rated but lower-yielding securities.

Some fixed-income funds seek to minimize risk by investing exclusively in securities backed by Govt. of India. These funds are suitable for investors who want to maximize current income and can take capital risk.

- Balanced Funds

Balanced funds aim to provide best of both growth and income. These funds invest in both shares and fixed income securities in a proportion mentioned in their offer documents.

Such funds are ideal for investors who are looking for a combination of income and moderate growth.

- Money Market Funds/Liquid Funds

These funds provide high stability of principal while ensuring a moderate to high current income. They invest in highly liquid, virtually risk-free, short-term debt securities of Govt. of India, banks and corporations and Treasury Bills.

Such funds are able to keep their unit price constant while the yield keeps fluctuating.

These funds invest only in highly liquid, short-term, top-rated money market instruments and are suitable for investors who want high stability of principal and current income with immediate liquidity.

- Specialty/Sector Funds

These funds invest in securities of a specific industry or sector of the economy such as health care, technology, leisure, utilities or precious metals. The funds enable investors to diversify holdings among many companies within an industry / sector.

They follow a conservative approach than investing directly in one particular company.

These funds offer the opportunity for quick capital gains when industry is "in favor" but also carry the risk of capital losses when the industry is out of favor. While sector funds restrict holdings to a particular industry, other specialty funds such as index funds give investors a broadly diversified portfolio.

Index funds generally buy shares in all the companies composing the BSE Sensex or NSE Nifty or other broad stock market indices. They are not suitable for investors who must conserve their principal or maximize current income.

- Gilt Fund

These funds invest in securities created and issued by the central and/or the state government securities and/or other instruments permitted by the Reserve Bank of India.

They generate returns which commensurate with zero credit risk. Since they ensure zero risk, they offer instant liquidity, tax-free income while their return is lower than income funds.

- Index Fund

Their goal is to match the performance of the markets by investing in stocks that constitute the benchmark indices. They work on passive fund management as they do not involve stock picking by the professional fund managers.

These funds just invest into the stock market in a way that is pre determined by benchmark indices and involves no further trading. Index funds are optimally diversified portfolios.

Scheme Structure

- Open-ended schemes

Open-ended schemes do not have a fixed maturity period nor do they have fixed time period till you can stay invested.

Investors can buy or sell units at NAV-related prices from and to the mutual fund on any business day. There is no upper limit on the amount you can buy from the fund while the unit capital can keep growing.

Open-ended schemes are preferred for their liquidity. Such funds can issue and redeem units any time during the life of a scheme. Any time entry option in an open-ended fund allows one to enter the fund at any time and even to invest at regular intervals.

- Close ended schemes

Close-ended schemes have fixed maturity periods. Investors can buy units of these funds at the time of NFO. After NFO offerings, such schemes Cannot issue new units except in case of bonus or rights issue.

Usually there is a high exit load if one wants to sell the units of a close ended scheme before the maturity time.

Special Schemes

- Tax Plan schemes

These schemes are meant to provide tax relief. Also known as Equity Linked Saving Schemes (ELSS) , they operate like any other growth fund which has the relative risk of growth fund with it. However, an investor in these schemes gets an income-tax rebate up to Rs 100,000 under section 80C & has a mandatory lock in period of 3 years.

What is NFO? How do you invest in NFO?

When an AMC launches a new scheme, it is known as a New Fund Offer (NFO). An NFO is like an invitation to investors to put their money into the mutual fund scheme by subscribing to its units.

When a scheme is launched, the distributors get in touch with potential investors and collect money from them either through cheques or demand drafts. The investor has to fill a form, which is available with the distributor. The investor must read the Offer Document (OD) before investing in a mutual fund scheme. An investor should also read the Key Information Memorandum (KIM), which is available with the application form. Investors have the right to ask for the KIM/ OD from the distributor.

What is meant by NAV? How is it calculated?

NAV stands for Net Asset Value of a single unit of Mutual Fund. NAV on a particular date reflects the realizable value of a mutual fund portfolio in per share or per unit terms. It is worth of an open ended mutual fund investment and also the amount an investor can expect if he/ she sells the units back to the AMC.

NAV is calculated by the formula = (Total Investment Value - Liabilities)/ Total no. of outstanding units

Use of NAV

- NAV tells you the extent to which, the securities that comprise the fund's portfolio have outperformed or underperformed the index.

- The use of certain statistical measures can also tell you whether a fund was able to derive above-average risk-adjusted returns.

What is meant by SIP? How is it different from regular Mutual Fund Investment?

The term SIP stands for Systematic Investment Plan. This plan is different from regular mutual fund investment which used to be in lump sum amounts. SIP allows you to invest in mutual funds in small amounts and on regular basis. You can choose to invest as low as Rs.1000 every month and stay invested in Mutual Funds.

SIP is different from regular Mutual Fund investment based on the following:

- In regular mutual fund investment, you need lump sum money to start investing while in SIP you can invest in small amount such as Rs.1000.

- Once you have invested in lump sum, you only track the performance of your mutual fund while in SIP, you can take your decision whether to continue investing in future in the same scheme and monitoring the fund performance at the same time.

- One cannot take advantage of price dips in Lump Sum investment while in SIP, you can take advantage of the same by accumulating more number of units while there is a price dip.

- SIP brings disciplined investment into practice while there may not be any discipline followed in lump sum investing.

What is systematic withdrawal plan (SWP)?

SWP stands for Systematic Withdrawal Plan. Here the investor invests a lump sum amount and withdraws some money regularly over a period of time which is pre defined by the investor.

Such type of withdrawal results in a steady income for the investor while at the same time his principal also gets drawn down gradually.

For example, an investor aged 60 years receives Rs. 20 lakh at retirement. If he wants to use this money over a 20 year period, he can withdraw Rs. 20,00,000/ 20 = Rs. 1,00,000 per annum. This will turn into Rs. 8,333 per month. (The investor will also get return on his investment of Rs. 20 lakh, depending on where the money has been invested by the mutual fund). With the effect of compounding being considered, he will be able to either draw some more money every month, or he can get the same amount of Rs. 8,333 per month for a longer period of time.

What is meant by Entry and Exit Load?

Loads are basically charges levied on your mutual fund investments which are basically recovery of sales, distribution & processing charges related to your investments.

An Entry load is a charge levied at the time of making investments so as to cover the expenses for sales, distribution and processing costs. It is the expense an investor has to bear while entering into mutual fund investment. However, not all funds have entry load and the same expense every mutual fund is different. A major portion of the Entry Load is used for paying commissions to the distributor. Entry loads increase the cost of buying an investment opportunity.

An Exit Load is a charge levied at the time of exiting mutual fund investment. Not all schemes have an Exit Load nor are the exit loads same for all schemes. Exit Loads depend upon the time period for which an investor stayed invested.

Generally, if the investor exits early, he will have to bear more Exit Load and if he remains invested for a longer period of time, his Exit Load will reduce. Thus the longer the investor remains invested, lesser is the Exit Load. After some time the Exit Load reduces to nil; i.e. if the investor exits after a specified time period.

What is meant by Switch option in Mutual Fund Investment?

Switch is a facility allowed by some mutual funds to their investors where the investors can switch between two schemes of the same fund. This facility is an added liquidity advantage for investors who wish to opt out of one scheme and invest in another without withdrawing the invested amount.

Switching allows the Investor to alter the allocation of their investment among schemes in order to meet their changed investment needs, risk profiles or changing circumstances during their lifetime. The fund may levy a switching fee for allowing the investor to switch between two schemes and making arrangements for the same.

How do I select a Mutual Fund for my investment?

You can select a mutual fund for investment based on the following criterions:

Past performance

Though past performance is not an indicator of the future, it does indicate to the investment philosophies of the fund, how it has performed in the past and the kind of returns it has offered to the investor over a period of time.

Also check the performance in the recent past years for consistency. How did these funds perform in the bull and bear markets of the immediate past? Tracking the performance in the bear market is particularly important because the true test of a portfolio is often revealed in how little it falls in a bad market.

Know your fund manager

The success of a fund to a great extent depends on the fund manager. A single fund manager can manage several funds and it follows that the funds managed by successful fund managers are successful as well.

Find out before investing, whether the fund manager or the investment strategy of the fund have changed recently as it may happen that the portfolio manager who generated the fund’s successful performance may no longer be managing the fund due to which investing in that fund may not prove to be a rewarding opportunity.

Does it suit your risk profile?

Before investing, you need to make sure that the fund you are investing into should match your risk taking capacity. If you have some risk taking capacity, you may go for a sector-specific scheme that comes with high-risk high-return.

If you are totally risk averse and don't want to suffer losses, you may opt for pure debt schemes with little or no risk.

You need to do your own study before you invest into any fund.

Read the prospectus

Reading a fund’s prospectus is a must in order to learn about its investment strategy and the risk involved in such investment. Most of your questions about the fund can be answered through the prospectus itself.

Funds with higher rates of return may take risks that are beyond your comfort level and are inconsistent with your financial goals. But remember that all funds carry some level of risk. Just because a fund invests in government or corporate bonds does not mean it does not have significant risk.

Matching the strategies and investment goals of the fund with your long-term investment strategies and tolerance for risk can help you decide what type of fund is best

Analyze your financial plan

In order to find the right mutual fund to invest, you need to determine whether you completely believe in equity or are you more worried about safety of your capital. How long do you intend to stay invested?

Can I withdraw my Mutual Fund investment any time?

You can withdraw your investment in mutual fund any time you want to. There is no such lock in period for mutual fund investments except for few schemes which are related to tax rebates. For all other schemes, you can exit from your investment any time. While investing & exiting in mutual fund investments, always remember that you may be charged high exit load on your investments if you exit soon after your entry into the fund which may reduce the return on your investment.

Hence, analyze the potential returns and reduction in return that you may have to face if you are exiting early from your mutual fund investment.

How do I know about current status of my Mutual Fund Investment?

You can keep track of your investments in mutual fund by either checking the NAV regularly through news papers, online websites. Also, you should get physical statements of your investments on quarterly basis and you can opt to receive digital statements of your investments and their current valuation.

Do I get any statement with details of my investment? What is the frequency of such statement?

Yes you are provided with regular updates of your investment on quarterly basis and if you opt for receiving such statements through email, you can get updates on your investment on monthly basis.

What are the different modes used to dispatch investment statements?

Currently there are two modes (physical and digital) used to dispatch investment statements.

How do I inform the AMC about any change in my contact details?

If there's any change in your contact details, you can contact your AMC through email, write a letter or call up your AMC to communicate the same. Once you have communicated the same, you will get a confirmation from the AMC for registration changes in your contact details.

Are there any taxes levied on Mutual Fund Investment?

There are no taxes levied on Mutual Fund Investments while there are some tax rebates applicable on the same. But there taxes to be paid on mutual fund investment returns according to certain criteria.

Is there any tax relief allowed on Mutual Fund Investment?

Only investment made in Tax Plan Schemes (ELSS) qualifies under section 80 © for tax rebate up to Rs 100,000.

Are there any taxes levied on Mutual Fund Investment returns?

Income earned by any mutual fund registered with SEBI is exempt from tax. Dividends to unit holders from a close ended fund or a debt fund pays a dividend distribution tax as per the government stipulation. Please note open ended equity oriented schemes (More than 50% in equity) are exempted from dividend distribution tax.

Dividend Taxation

Yes there are taxes levied on Dividend Income from Mutual Fund investment as well as sales proceeds of mutual fund investment which may not be payable directly by the investor.

Dividend income at the investor's end is not taxable for any of the schemes but for dividend distribution of schemes other than Equity schemes, there is a distribution tax on dividend @12.81% payable by the distributor.

Understand the rules and regulations of Mutual Fund investment

It is of utmost importance that you are aware and clear about the rules and regulations governing the investment instrument that you aim to invest in. It is better to be aware of the facts related to your investment than be in awe with the situations facing your investment decision.

Be aware of the rights and obligations of investing in Mutual Funds

When investing in mutual funds, don't find yourself in a situation where you seem to be lost with no one to help / direct you. The following can be helpful to you in ascertaining what you can do when you find yourself in discomfort:

Rights

- Investors have a right to receive the dividend within 30 days of declaration.

- On redemption request by investors, the AMC must dispatch the redemption proceeds within 10 working days of the request. In case the AMC fails to do so, it has to pay an interest @ 15%. This rate may change from time to time subject to regulations.

- Investors can obtain relevant information from the trustees and inspect documents like trust deed, investment management agreement, annual reports, offer documents, etc. They must receive audited annual reports within 6 months from the financial year end.

- Investors can wind up a scheme or even terminate the AMC if unit holders representing 75% of scheme’s assets pass a resolution to that respect.

- Investors have a right to be informed about changes in the fundamental attributes of a scheme. Fundamental attributes include type of scheme, investment objectives and policies and terms of issue.

Lastly, investors can approach the investor relations officer for grievance redressal. In case the investor does not get appropriate solution, he can approach the investor grievance cell of SEBI. The investor can also sue the trustees.

Obligations

- In case the investor fails to claim the redemption proceeds immediately, then the applicable NAV depends upon when the investor claims the redemption proceeds.

- The offer document is a legal document and it is the investor’s obligation to read the OD carefully before investing. The OD contains all the material information that the investor would require to make an informed decision.

It contains the risk factors, dividend policy, investment objective, expenses expected to be incurred by the proposed scheme, fund manager’s experience, historical performance of other schemes of the fund and a lot of other vital information.

Which investment option (SIP / Lump sum) is better for Mutual Fund Investment?

None of the options is bad to invest in mutual funds. It is only a matter of your current financial position, future financial goals, your age and which option suits you better. If you have lump sum money to invest in one go an do not prefer to invest in small amount through month on month basis; you can opt for Lump sum investment option. Lump sum investment will fetch you good returns when it comes to dividends or withdrawing your investments in profit.

If you don't have lump sum money to invest and would rather prefer to invest through month on month basis; you can opt for SIP which allows you to invest even in small amounts such as Rs.1000 a month. By opting for SIP, you can follow disciplined investing and can enjoy the benefits of compounding of your investments. Unlike lump sum investment, you can take advantage of market dips where you can accumulate more units which is not available in lump sum investment.

Which investment plan (Growth / Dividend payout / Dividend reinvestment) is better for Mutual Fund Investments?

Many a times investors feel that the dividend reinvestment option is better than growth as they get more number of units. Let’s understand the three options:

Growth Plan

Growth plan is for those investors who are looking for capital appreciation and do not need to earn regular income from their investments.

Such as an investor aged 25 invests Rs 10 lakh in an equity scheme at an NAV of Rs.100. He would not be requiring a regular income from his investment as his salary can be used for meeting his monthly expenses.

He would want his money to grow in future rather than getting regular income out of it and opting for Growth plan will help in achieving the same if he remains invested for a long period of time. For the whole time period he stayed invested, his total no. of units will remain the same but the valuation of his investment will keep reflecting the performance of the fund he has invested in.

Dividend Payout Plan

In the above example, if he chooses Dividend Payout plan and his investments earn a dividend of Rs. 10 on every unit held after 1 year; he would receive Rs. 100000 as dividend. He may have got current income from his investment but this would deny him the benefit of compounding of this dividend amount into his portfolio as the NAV of his holdings will fall by Rs.10.

Hence, dividend payout will take away that Rs.100000 out of the scheme and thus will not continue to grow like it would have if the same had been kept invested.

Dividend Reinvestment Plan

In the above example, if he chooses Dividend Reinvestment plan, the dividend of Rs.100000 due to him is invested back in the scheme thus he gets Rs.100000/100(NAV after dividend)= 1000 units extra in his holding units. Though he as got extra units, the NAV of the scheme has gone down by Rs.10 to Rs.100 again which was his original buying price.

As you can see, the return in case of all the three plans would be same and there is no difference in either Growth or Dividend Reinvestment Plan.

It must be noted that for equity schemes there is no Dividend Distribution Tax, however for debt schemes, investor will not get Rs. 10 as dividend, but slightly less due to Dividend Distribution Tax.

In case of Dividend Payout option the investor will lose out on the power of compounding from the second year onwards.

What are the factors that affect the returns on my Mutual Fund investment?

The performances of Mutual funds are influenced by the performance of the stock market as well as the economy as a whole.

Equity Funds are influenced to a large extent by the stock market. The stock market in turn is influenced by the performance of the companies as well as the economy as a whole.

The performance of the sector funds depends to a large extent on the companies within that sector.

Bond-funds are influenced by interest rates and credit quality. As interest rates rise, bond prices fall, and vice versa. Similarly, bond funds with higher credit ratings are less influenced by changes in the economy.

What if I am unsatisfied by the performance of Mutual Fund investment?

If you are not satisfied by the performance of your mutual fund investment, you can consult a professional to suggest you whether you should stay invested or exit from the scheme. Accordingly you can either:

Withdraw your investments from the scheme completely

Switch your investments from one scheme to another under the same fund which is performing better than the scheme you are currently invested in.

Switch to another plan (from dividend to growth or vice versa) as applicable to your risk and investment profile.

What if I stop my SIP payment?

You can stop your SIP payment when you wish to but in ELSS scheme ie tax saving schemes, you are not entitled to withdraw your funds as it has a lock in period of 3 years.

If a mutual fund scheme is winded up, what happens to my investment in the same?

In case of a mutual fund scheme being winded up, the mutual fund would pay the sum due to an investor according to the prevailing NAV and after adjusting other expenses from the same. The mutual fund would also issue a winding up report to all investors with necessary details about the winding up.

If a mutual fund scheme is winded up, what happens to my investment in the same?

In case of a mutual fund scheme being winded up, the mutual fund would pay the sum due to an investor according to the prevailing NAV and after adjusting other expenses from the same. The mutual fund would also issue a winding up report to all investors with necessary details about the winding up.

Learn about the kind of investment portfolio Mutual Fund holds

You can learn about the kind of investment portfolio your mutual fund holds by referring to information available on the web which can give you a clue as to which are sectors that your fund is banking on for good performance and good returns to investors. This will also help you to analyze whether to stay invested in the same scheme or not; if it doesn't follows matches your risk profile and investment goals.

Check the NAV of your investment regularly

Checking the NAV of the fund you have invested in on regular basis will help you to analyze as to how is the fund performing in current scenario and then you can also compare it with other funds in order to check if it is performing at par with other funds of the same category.

Number of schemes you should invest in

There is no restriction on investing in no. of schemes. But from the point of view of manageability, ideally it should be not more than 8 to 10. Please note the manageability factor entirely depends on investor.

Mutual Fund is not safe for investment

Just like any other financial instrument, mutual funds are not without risk. When defined in terms of chances of losing money, the risk in mutual funds is no different than any other financial instrument. But they are relatively safer and a more convenient way on investing. In mutual funds, you can control risk by choosing a fund that suits your risk profile. On the other hand, picking stocks individually that will both meet your objectives and match your profile can be tough. A mutual fund portfolio is easier to monitor than equity shares. They also come with less systemic risks. They offer quick liquidity. Most private mutual funds can be redeemed in three to four working days. This cuts the overall risk associated with investing in mutual fund. But the market risk or the risk that exists due to economy-wide factors remains. As there are many factors that affect the performance of a mutual fund and due to the very diversified nature of mutual fund investments, they provide a cushion to your portfolio which makes it more safer than direct equity investment.

It requires good sum of money to invest in Mutual Fund

As we have are now aware of the different ways one can invest in mutual funds, we also know that one can start to invest in mutual funds by just investing a small amount as Rs.1000 per month and stay invested on regular basis. Once can either invest through lump sum investment or go through SIP to invest in small amounts and get the benefits of investing as well. Hence, it is wrong to say that it requires good sum of money to invest in Mutual Fund.

Fund Managers play with your money

It is completely untrue to say that Fund Managers play with your money. Fund managers are hired to take investment decisions on behalf of the clients and to maximize the returns on such investments. Their responsibility to act in the best interest of investor's as per the investment objective of the fund mentioned in offer document. They are well qualified, experienced and trained in what they do. It is very unlikely that they will take any action detrimental to investor's interest.

There is no Entry and Exit timing for Mutual Fund investment

Like every investment, mutual fund investments also have an appropriate entry and exit timings. Every mutual fund scheme has its own peak performance (best time) and bad time. If you enter into a scheme when it is at its peak, you may not get the rewards of investing in the same as after the peak time, it will show sign of slow down which is not rewarding.

If you invest into a fund when it is on the falling end, it would make no sense to invest in it or stay invested. You would rather consider exiting the scheme at such a point. Hence, there is certain time to enter or exit the mutual fund schemes also.

Be systematic in your investment

Every kind of investment requires a discipline that needs to be followed if one wants to reap the benefits of investing. If you are consistent, systematic and regular in your investment, you can enjoy the benefits of compounding and cashing on the investment opportunity in every market dip.

Read the offer document carefully

The offer document of every mutual fund holds the key information to its investment approach, investment objective, fund managers etc. It is therefore always advisable to read through the offer document carefully in order to be thorough with the terms and conditions governing such investment. Many investors often skip the minute details mentioned in the offer document.

Always try to understand your investment statements sent to you

If you wish to be up to date with the changes taking place in your portfolio, know whether it is in profit, what does your portfolio consists and what is expected out of the current status of your portfolio; it is necessary that you read through the investment statements sent to you and try to understand the same.

Stay invested in a scheme to reap the benefits of long term investment

Investing is a matter of patience and wise investing decision. Every investment has its time period for maturity after which it will start giving you the fruits of your wise investment and staying invested. If you can hold on to your investments for a considerable time period, you will be able to reap the benefits of staying invested once you have crossed an appropriate time horizon. It is best advisable to remain invested in a scheme that matches your criterion and has growth & earnings potential.

Analyze the balance of risk and rewards involved