-

Trading through your account

-

Taxes & Charges

-

Commodity Trading Support

-

Getting Started

-

Getting familiar with commodities

-

Understanding Commodity trading

How do I get a confirmation of whether my order has been executed or not?

If you have placed your order online through the trading terminal, you can view the pending order book by using the shortcut key "F3". If you have placed your order offline through your branch, the dealer will you the order confirmation immediately on execution of the same.

How do I see my holdings?

If you have a Demat account with AnandRathi, monthly demat statements will be sent to your correspondence address registered with us.

What are the expiry dates of commodity futures?

Normally commodity futures are for one month period. All exchanges make available 3-4 future contracts at a time. Agriculture futures normally expire on 20th of the relevant month and other futures expires generally on 5th of next month. If expiry date is a public holiday or non working day, contract will expire on the previous working day.

Do I need to carry all positions or else can I square off my trade intraday?

You can either square off your trades intraday before the market closes or roll over the positions to next day till the expiry of contract.

What are the various functions available on trading system?

The following functions can be used for trading on the commodity trading terminal:

- F1/+: To buy a contract

- F2/ - : To sell a contract

- F3: To View pending orders

- SHIFT+F1:cancel pending orders lying in the trading system

- SHIFT+ F2: To modify order

- F6: To view top five buyers and top five sellers (Market Picture)

- F8: To view all executed trades

- Shift + F7: To see market info about a particular commodity contract

What are various information I need to put while entering an order online?

While you are placing your order, you need to enter the "quantity" that you wish to buy / sell and the "intended price" at which you wish to place your order.

Do I need to provide any information at the time of order placement through the branch?

Yes you need to keep your account details handy if you wish to place your orders offline. All offline order requests are accepted only on recorded phone lines. So any order request will not be entertained if it is given on mobile phones / non recorded phone lines.

What are the various charges applicable for trading in commodities?

Following charges are applicable for commodity trading:

- Brokerage: As decided as the time of account opening, payable to broking house subject to Minimum Rs 25 per Contract

- Exchange Fee: As per Exchange norms

- Stamp duty: - Applicable as per State norms

- Service Tax: - As per government norms

Do I need to pay any sales tax / VAT on commodity derivative transaction?

If you square off your trades before expiry of the contract, there is no Sales Tax / VAT payable. But if you take delivery of the commodity, sales tax / VAT will be applicable as per the existing government rules.

Do I need to take sales tax / VAT registration for trading in commodity derivative?

Sales tax / VAT registration is required if you take physical delivery of commodities & if you don't wish to take the registration, we can provide C&F agent services with certain charges to complete the transaction.

Is there any website I can get information about exchanges?

You can refer to the following exchange websites to learn about the commodity exchanges:

- Multi Commodity Exchange: www.mcxindia.com

- National Commodity & Derivative exchange: www.ncdex.com

- National Multi Commodity Exchange: www.nmce.com

What are the various reports I can get from back office?

You will get daily MTM bill (contract note) either by post or by email (if you accepted to get MTM bills in soft copy). Following reports can be availed of from our back office

- Detailed Ledger

- OPE Positions report

If I have any doubts, how do I get a help over the same?

In order to get your queries addressed, you can either can contact your respective branch where you have a trading account with us or the centralized team placed at Mumbai on +91 022 6626 6460.

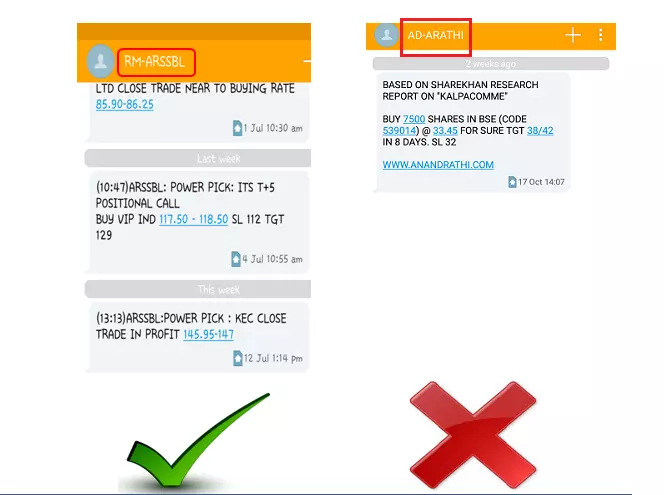

Will I get research support from Anand Rathi? Is there any charge for these services?

As a value added service, we provide professional research services by our in house research team. This service is available to all clients free of cost.

What kind of research I will get from AnandRathi?

AnandRathi commodity research services provide following research:

- Intra day calls: Based on technical research on intraday market movement. These calls are sent to all clients via SMS and flash on trading terminals.

- Short term to medium term calls: based on technical as well as fundamental research analysis. These calls are sent to clients on email as daily research report.

- Long term calls: based on fundamental research analysis. These calls are sent to clients on email as long term research call / One pager research calls

Which commodities are covered by AnandRathi Research Services?

All volatile commodities are covered by Anand Rathi Research Services. To be put across on gross level, we cover the following commodity categories for our research services:

- Precious Metals

- Gold

- Silver

- Energy

- Crude Oil

- Natural Gas etc.

- Base Metals

- Copper

- Nickel

- Lead

- Zinc etc.

- Agri Commodities

- Turmeric

- Sugar

- Chilli

- Guargum etc.

What accounts I will have to open in order to trade in commodities with AnandRathi?

In order to be able to trade in commodities with AnandRathi, you need to open the following accounts:

Trading Account

Demat Account (if you wish to take delivery of your trades)

Note: Bank account details need to be registered at the time of account opening however, it is not mandatory to link your bank account with the trading account.

In order to trade in more than one exchange, the respective number of document copies also needs to be submitted.

What are the documents required for commodity trading?

The following documents are required for commodity trading:

Identity Proofs:

- Pan Card

Address Proofs(Any one document):

- Passport

- Voter ID

- Driver License

- Bank Passbook

- Rent Agreement

- Ration Card

- Latest Utility Bill (Not more than two months old)

Banking Proofs:

- Canceled cheque

- Bank Statement

How will I come to know that my account has been opened?

Once your account has been opened, our Relationship Manager will inform you about your trading account details and help you to familiarize with your account usage.

I have my account opened and received the trading account details. How do I proceed now?

On receiving your trading account details, you need to pay a margin cheque in order to be able to trade from your account. Margin requirement differs from commodity to commodity.

You can trade either through offline mode by calling our dealing desk at your nearest branch OR the centralized dealing desk. We provide offline trading facility since morning before markets open till 12 in the night.

You can trade online if you have an online account & trading terminal installed at your computer.

Which are exchanges I can trade in with AnandRathi?

AnandRathi has a membership in various domestic as well as international exchanges. Our prime motive is to provide both offline as well as online access to our clients.

We are the members of:

- National Commodities and Derivatives exchanges (NCDEX)

- Multi Commodity Exchanges (MCX)

- NSE SX (NSE Currency)

- MCX SX (MCX Currency)

- Dubai Gold & Commodity Exchange (DGCX) & London Metal Exchange (LME)

- NCDEX Spot Exchange

- MCX Spot exchange & National Multi Commodity Exchange (NMCE)

Which are the commodities I can trade with Anand Rathi?

A wide range of commodities are available for trading with Anand Rathi. A few of those commodities are Base metals i.e. Copper, Nickel, Zinc, Tin etc., Precious Metals i.e. gold, Silver, Energy futures i.e. Crude Oil, Natural Gas, Agriculture Futures i.e. Soya Bean, Chili, Turmeric, Cumin Seeds etc

Are corporates allowed to trade in commodities in India?

Yes, in India, Corporates are also allowed to trade in commodity derivatives.

How do I place an order with Exchange through AnandRathi?

Orders can be placed either online if client has applied for the facility or offline by calling our dealing desk.

If I have an online account but cannot access your computer, is there any other mode available to place my orders with Anand Rathi?

Though you have an online account but cannot access your computer, you can put your orders offline with the branch which operate your account or the centralized dealing desk through your relationship manager at the centralized team's contact numbers.

What are the trading timings with Anand Rathi?

You can trade in commodities with AnandRathi throughout the time when trading is carried out on the commodity exchanges (Morning 10 am till 12 at mid night).

Is there any no delivery or commodities temporarily banned for trading also as is with equity trading?

Market regulator FMC has a right to ban any commodity from further trading with prior intimation. Thus right can be exercised to protect the common investor's interest. Certain commodities are cash settled only contracts like crude oil, natural gas. Hence in these cases, the no delivery option will be available.

How is the margin calculated in commodity trading?

Margins are calculated at a certain percentage prescribed by the exchange every day. These margin percentages are decided by the exchange considering the market conditions, volatility and other factors. Margins are applied to the total contract Value of the position taken by a client. If you wish to know the margins applicable to specific commodity of your interest, you can contact us for the same.

How are commodity trades settled at AnandRathi?

As prescribed by the Commodity Market Regulator Forward Market Commissions, commodity trade profits / losses will be settled daily till the expiry or square off the same. On the expiry of trade if not squared off, will be settled in either delivery or cash depending on the choice available on contracts.

Can I take physical delivery of commodities? How are they settled?

You can opt for physical delivery of commodities other than the contracts which are settled compulsorily in cash like crude oil, natural gas etc. If you wish to take physical delivery, you will need to create a trading position and then on expiry of the contract, you need to give delivery instructions to your Relationship Manager/Branch or to HO operations team on 1800 200 1002/1800 102 1003 (Toll Free) or 022 - 3950 9800/ 4222 1313 (Tolled).

What is the trading & settlement cycle followed in commodity trading?

Commodity trading is available in monthly futures. Each contract expires on dates that are pre decided by the exchanges they are traded on. The settlement cycle followed for Trading profits is T+1 and for delivery positions T+2.

-

Getting Started

Why do I need to Open an account for trading?

As per the regulations governing

financial markets, if you wish to trade / invest in any financial instrument, you will need to open an account in order

to register your details with the market regulators. This also helps in identifying an individual investor from all other

investors for consideration of benefits accrued to such investors.

Who is eligible to open a

trading account with Anand Rathi?

Any individual, Hindu Undivided Family, proprietary firm,

partnership firm or a company can open a trading account with Anandrathi.com.

I want to

open an Online Trading account, how do I register?

- Visit our website www.rathi.com

- Click 'Register Online' (Link is available at top right)

- Provide the asked details and then click Submit

- For further assistance connect to us on our Chat Box tool 'Chat With Us' on www.rathi.com (Link is available at top right) from Mon-Fri 9:00 am to 5:00 pm & Sat 10:00am to 3:00 pm.

OR

- Call us on our Toll Free Nos 1800 200 1002/1800 121 1003 or on our Tolled Nos 0291 3091400/ 0291 7117001.

-

Market timings

-

Account related

-

Stock Alerts

-

Pay in & Pay out

-

RMS related

-

Rejected Orders

Equity

|

Trade Time |

NSE/BSE: 09:15 am to 3:30 pm | |

|

Post Close Trade Time (NSE) |

03:40 pm to 04:00 pm | |

| Post Close Trade Time (BSE) | 03:40 pm to 04:00 pm | |

|

Compulsory Square Off (BSE / NSE) |

03:15:00 PM | |

|

AMO order timings

| Equity (NSE, BSE, NSEFO & BSEFO) | 4:30 pm to 8:45 am | |

| Commodity (MCX & NCDEX) | 12:15 am to 9:45 am | |

| Currency (MCXSX & NSECDS) | 5:30 pm to 8:45 am | |

| DGCX | 2:00 am to 8:15 am |

Commodity

| Agri market |

Mon-Fri: 10:00am to 5:00pm |

|

| Non-Agri market |

Mon-Fri: 10:00am to 11:30pm |

|

|

Currency Market

|

Mon-Fri 9:00am to 5:00pm

Sat market closed For further assistance connect to us on our Chat Box tool 'Chat With Us' on www.rathionline.com (Link is available at top right) from: Mon-Fri 9:00am to 5:00pm & Sat 10:00am to 3:00pm |

Password Reset/ Forgot Password

- Invoke login page (www.rathionline.com) & Click on forgot password

- Click on 'Forgot Password for On-line Trading'

- Provide the required details namely User ID, Email ID, PAN No. registered with the trading system

- Click on Submit

- After validating provided details to reset passwords, system will generate new passwords & you will receive the passwords on registered email address instantly

- System will force to change both Login & transaction passwords on first time login after password reset request has been replied

- For further assistance connect to us on our Chat Box tool 'Chat With Us' on www.rathionline.com (Link is available at top right) from Mon-Fri 9:00 am to 5:00 pm & Sat 10:00am to 3:00 pm

Step 1 - Manual Authentication through our Service Representative

Step 2 - Get TPIN on successful manual authentication

Step 3 - Follow instructions on IVR to change TPIN

Step 4 - Authenticate new T-PIN

Step 5 - Access Account/Place Order

- Forms are available to download on our website (www.rathionline.com). Just click on 'Online Services'

- Then Click on 'Customer Care Desk'

- Go to 'Profile Update' click on 'Email ID change and RMS LOA'

- Submit the duly filled form at your nearest AnandRathi branch or post the duly filled form to our Goregoan (East) Corporate Office.

Set Stock Alert

How do I set Stock Alerts for we-based trading account?

- SMS Alerts can be selected if mobile no. is registered with the trading system

- SMS & Email tick will display only registered E-mail & Mobile No.

- Login to your AnandRathi on-line account

- Click on 'Alerts'

- Click on 'Set Alerts'

- "Choose option to Set Alerts, Security, Index or Trade Alert. Tick Alert source to receive alert, SMS, Email or Web/TWS.

- If you want SMS alert on Index then select 'Index'

- If you want SMS alert on any scrip or future then select 'Security Trade Data'

- If you want SMS alert on a scrip or future on which you have place order then select 'Personal Trade Data'

After selecting 'Index'

- Select the Exchange from the drop-down box provided

- Select 'Cell Phone' (you can avail for the alert to be sent via SMS only)

- Click 'Confirm'

- Next page select the name of the Exchange from the drop-down box

- Select the criteria you want for the alert eg :greater than or equal

- Then enter the figure which when reached you want the SMS alert to be triggered

After selecting 'Security Trade Data'

- Select the Exchange from the drop-down box provided

- Select 'Cell Phone' (you can avail for the alert to be sent via SMS only)

- Click 'Confirm'

- On next page select the name of the Exchange from the drop-down box

- Then select the type to which the security belongs

- Then enter some starting letters of the company name

- Click 'Go'

- You then get a list of company names beginning with the letters. Select the name of your choice

- Select the option from the drop-down box provided in 'Alert Based on'

- Select the option from the drop-down box provided in 'Alert Action If''

- Then enter the figure which when reached you want the SMS alert to be triggered

After selecting 'Personal Trade Data

- Select the Exchange from the drop-down box provided

- Select 'Cell Phone' (you can avail for the alert to be sent via SMS only)

- Click 'Confirm'

- On the next page select the order for which you want to set the alert

- Click 'Set Alert'

- Click 'Submit'

How do I set Stock Alerts for software-based trading account?

- Go to 'Tools'

- Select 'Set Alerts'

- Index Alerts,

- Security Alert

- Choose Index name from drop-down box

- Select the option from the drop-down box “Alert me if the value is' (eg: Greater than or equal to)

- Enter Value

- Remarks (optional – it will be visible in the alert which you set)

- "Select Alert type:

- SMS

- TWS (here the alert will be flashed on the computer screen)"

- Click 'Set Alert'

Security Alert

- Select 'Exchange Segment' (If Alert to be set for FUT & OPTION then select NFO/CDS)

- Select Instrument Name (Eg: EQ, FUTIDX, FUTSTK, etc))

- Select Symbol (Eg: Co. Code, Co. Name, Index Name, etc)

- Select the 'Type'

- Criteria for reaching value (Eg: Greater than or equal to)

- Enter Value

- Remarks

- "Select Alert type:

- SMS

- TWS (here the alert will be flashed on the computer screen)"

- Click 'Set Alert'

- Go to 'Tools'

- Select 'Set Order Alert'

- Select NEST Order No, double click on the order no selected

- Select Order Status, double click on the status selected

- "Select Type of Alert

- TWS

- (Here you do not have the option of selecting the Alert Type 'SMS')"

- Click Set Alert

- For further assistance on any queries regarding setting alerts connect to us on our Chat Box tool 'Chat With Us' on www.rathionline.com (Link is available at top right) from Mon-Fri 9:00 am to 5:00pm & Sat 10:00am to 3:00 pm

How to Transfer Funds On-line into my Trading account

- Login to your AnandRathi on-line account

- Click 'Fund Transfer'

- Click 'Pay In'

- Select Bank Name, The Segment for which money is being transferred, To Account No & Amount

- Click 'Submit'

- Login to your AnandRathi on-line account

- Click 'Fund Transfer'

- Click 'Pay Out Request'

- Select the Segment's Fund to be transferred into your Bank Account

- Check the your Bank Name, A/c no & money to be requested for, confirm the bank a/c no

- Click 'Submit'

- Pay in Status can be checked on-line

- Login to your AnandRathi on-line account

- Click on 'Transfer Status' under 'Fund Transfer'

- You can check your Pay in/Pay out status

For further assistance on any Pay in/Pay out related issue connect to us on our Chat Box tool 'Chat With Us' on www.rathionline.com (right-hand side top of the page) from Mon-Fri 9:00am to 5:00pm & Sat 10:00am to 3:00pm

OR

Write to us at customersuport@rathi.com with your User ID.

OR

Call us on 1800 200 1002/1800 121 1003 (Toll Free) or 0291 309 1400/ 0291 711 7001 (Tolled)

Holdings not updated (off market/DP/IPO)

- Off market transfer are updated in our DP once its debited from exiting DP

- Login to your Anand Rathi on-line account

- Click on 'Report'

- Click on 'Depository' you will get the details of your off-market/DP/IPO holdings

For further assistance connect to us on our Chat Box tool 'Chat With Us' on www.rathionline.com (Link is available at top right) from Mon-Fri 9:00 am to 5:00 pm & Sat 10:00am to 3:00 pm

OR

Write to us at customersuport@rathi.com with your User ID.

OR

Call us on 1800 200 1002/1800 121 1003 (Toll Free) or 0291 309 1400/ 0291 711 7001 (Tolled)

Basic information on trading

For Basic Information on trading Click Here

Placing Orders

I want to place a sell/buy order. How to place an order?

- Login to your AnandRathi on-line account

- Click on menu tab 'Trade'

- Click on 'Quick Order'

- Select the exchange you would like to place order for

- Enter the symbol or scrip name for Eg: Godrej

- Click on search to retrieve list of respective symbol

- Choose the symbol to place an order

- Select Parameters as order type, product Etc. (Product Name (MIS = Intra Day, CNC = Cash N Carry (Delivery))

- Check order details & confirm to place order (Order confirmation message will appear on pop-up, Order details can be seen under order book)

I want to place After Market Order. How do I place it?

- Login to your AnandRathi on-line account

- Click on menu tab 'Trade'

- Click on 'AMO Quick Order'

- Enter the symbol or scrip name for Eg: Godrej

- Click on search to retrieve list of respective symbol

- Choose the symbol to place an order

- Select Parameters as order type, product Etc. (Product Name (MIS = Intra Day, CNC = Cash N Carry (Delivery))

- Click 'Submit'

- Check order details & confirm to place order. Check order details & confirm to place order (Order confirmation message will appear on pop-up, Order details can be seen under order book)

Unable to place sell order as it states insufficient stock in DP account though I hold shares.

- Check if holdings have been updated DP account

- Exe user = Under surveillance – View Holdings

- Web Users = Under Position

- Holdings Streamer Users = Holdings

- Contact our Customer Support Desk for further help they will help you get the shares updated in your DP account. For further assistance on any Order Placing related issue connect to us on our Chat Box tool 'Chat With Us' on www.rathionline.com (right-hand side top of the page) from Mon-Fri 9:00 am to 5:00 pm & Sat 10:00am to 3:00pm

OR

- Write to us at customersuport@rathi.com with your User ID.

OR

- Call us on 1800 200 1002/1800 121 1003 (Toll Free) or 0291 309 1400/ 0291 711 7001 (Tolled)

Can shares bought in NSE can it be sold in BSE?

It can be sold on same day provided you have holdings available in your Demat account, else it can be sold next day

I have bought shares however unable to sell the same on the same day?

The reason for not being able to sell the shares the same day it was bought could be:

1. If you have bought shares from NSE and trying to sell in BSE

2. If you bought shares for intra-day trading (MIS) and try to sell it in Delivery call (CNC)

3. If you have already placed a sell order under CNC, which is already open & not executed & trying to place another order of the same nature, without canceling the open order

Market Watch

How do I initialize Market Watch

- Login to your Anand Rathi on-line account

- Click on 'Market Watch'

- Click on 'Set MW'

- Click on 'Create MW'

- Type the name you would like to give to Market Watch in the text box

- Select the scrips, required to view in the market watch & click on add (you can add 30 scrips to one market watch)

- Click on the name of the scrip from the text box 'Company Name' (Note: You can select the multiple scrips by holding a control key & select different scrips)

- Then click on 'Add'.

- The scrip name will appear in the 'Selected Company' text box.

- Click on 'Add to Market Watch'

- You can create as many Market Watches you want. (recommend to create maximum 5 to get better performance on Streamer)

- For further assistance connect to us on our Chat Box tool 'Chat With Us' on www.rathionline.com (Link is available at top right) from Mon-Fri 9:00 am to 5:00 pm & Sat 10:00am to 3:00 pmOR

-

Write to us at customersuport@rathi.com with your User ID.

- Call us on 1800 200 1002/1800 121 1003 (Toll Free) or 0291 309 1400/ 0291 711 7001 (Tolled)

Tr@de X'press

What is the function of Tr@de X'press? /How will Trade Express help?

- You can see real time price up-dates of scrips on Trade X'press, where as in the static market watch you are required to refresh to get the latest updates

- Research calls given by our analysts are flashed and can be seen immediately under Admin Messages tab

- You can toggle between the multiple market watch created, by changing market watch as required through a Market watch drop down

- For further assistance connect to us on our Chat Box tool 'Chat With Us' on www.rathionline.com (Link is available at top right) from Mon-Fri 9:00 am to 5:00 pm & Sat 10:00am to 3:00pm

OR

- Write to us at customersuport@rathi.com with your User ID.

- Call us on 1800 200 1002/1800 121 1003 (Toll Free) or 0291 309 1400/ 0291 711 7001 (Tolled)

Balance inquiry

Balance Margin amount in your account can be checked on-line

- Login to your Anand Rathi on-line account

- Click on 'Limits'

Dealers

To speak with our dealers

- Call us on 1800 200 1002/1800 121 1003 (Toll Free) or 0291 309 1400/ 0291 711 7001 (Tolled)

- Click here to know our 'Call Flow'

Holding Information

Off Market/IPO/Shortage

- Login to your Anand Rathi on-line account, click on holding (Exe users = Under surveillance – Holdings – View holdings)

- Click on the menu tab 'Position'

- Click on 'Holdings'

Order Status

Where do I check on-line the status of the order that I have placed?

- To check on-line the status of the order you have placed login to your Anand Rathi on-line account

- Click on 'Order Book'' under 'Trade'

- You can check the status of the order you have placed

- You can check the order execution report under Trade book

- To check Trade Book login to your Anand Rathi on-line account

- Click on 'Trade Book' under 'Trade'

Rejected Orders

What is the function of Rejected Orders Option?

- You can check the details of the rejected orders along with the reason for rejection

- To check Rejected Orders login to your Anand Rathi on-line account

- Click on 'Rejected Orders' under 'Trade'

For further assistance connect to us on our Chat Box tool 'Chat With Us' from Mon-Fri 9:00 am to 5:00 pm & Sat 10:00am to 3:00 pm

OR

Write to us at customersuport@rathi.com with your User ID.

OR

Call us on 1800 200 1002/1800 121 1003 (Toll Free) or 0291 309 1400/ 0291 711 7001 (Tolled)

-

Getting Started-Adding a Transaction

-

Portfolio Summary - Net Worth

-

Holdings-Equities

-

Holdings-MF

-

Transaction History

-

Gains & losses

How do I add an equity transaction?

You can either click on Add Trx button on the page tool bar in the Equities holding section or use the right click option available on existing scrip in your equity holdings.

- Select the company that you wish to add to your portfolio. You can enter initial alphabets of the Scrip code or company name. This will throw matching results dynamically, if any are found. Select the scrip that you want to enter.

- Enter other transaction details like the quantity, transaction type, transaction date, Trx. Price and remarks, if any.

- You can enter as many transactions of the same company or of different companies at one go.

- In case you are done with adding transactions for now, click on save button and view the outcome.

How do I add Mutual Fund transactions?

You can either click on Add Trx button on the page tool bar in the MF holding section or use the right click option available on existing scheme in your MF holdings.

- Select the scheme through the Fund / Scheme search box.

- Enter the Folio Number.

- Select the appropriate Transaction Type.

- Enter the transaction date.

- Enter the transaction value and the total amount that you have invested.

- Enter the transaction NAV at which you have bought the scheme. You can enter up to four decimal places.

- Enter the units which you have bought under the scheme. You can enter up to 3 decimal places.

- You can enter as many transactions of the same company or of different companies at one go.

- In case you are done with adding transactions for now, click on save button and view the outcome

Can I add short sell transactions?

Yes, you can add short sell transactions in both equity and mutual fund investments. This will also be reflected in the Short Position under Investment Listing. Such transactions will also be considered while computing Asset Allocation and % of portfolio.

Can I delete transactions in portfolio?

You can delete or edit those transactions in the portfolio, which you have added. However, the same cannot be done for those transactions which are updated automatically for transactions done through ANAND RATHI SHARE AND STOCK BROKERS LIMITED.

Do transactions take into account the brokerage paid?

Yes, your purchase / sell price is available with the breakup of brokerage charges and all other charges like STT, Transaction Tax etc. charged on your transaction.

Does transactions account for auction entries?

Yes, in case any transaction results in auction all such transactions will also be automatically added as either buy/sell transactions and will not be highlighted separately.

Will all corporate actions be taken care of automatically?

Yes, our application will introduce transactions for corporate actions like bonus, split, dividend but you can manually override the same. Also, CA like rights have to be manually added.

How do I add Fixed Deposit transactions?

You can click on Add Trx button on the page tool bar in the Fixed Deposit holding section.

- Enter the FDR No.

- Enter the Investment amount.

- Select the option of Simple Interest or Cumulative Interest whichever is applicable.

- Enter Interest Rate, Investment Date & Expiry Date.

- Now click on Ad Trx button and view the outcome.

How do I add Bullion transactions?

Select the metal from drop-down box.

- Enter the Quantity bought

- Enter Buy/Sell & Transaction Date

- Enter price per measurement

- Now click on Ad Trx button and view the outcome

What is Cash In Hand?

Cash in Hand includes your Ledger Balance with ANAND RATHI SHARE AND STOCK BROKERS LIMITED. You can enter other cash in hand balances through Add trx facility.

Can I edit or delete Cash In Hand details?

You can delete or edit those transactions in the portfolio, which you have added. However, the same cannot be done for ledger Balance which is through ANAND RATHI SHARE AND STOCK BROKERS LIMITED.

How do I add Insurance transactions?

Select the Insurance Company name and the Policy.

- Enter the Policy No, Mode of Payment, Premium Amount, PPT, Policy Date, Sum Assured & Maturity Date.

- Now click on Ad Trx button and view the outcome.

How do I add my Borrowing Details?

Select the Instrument/Type of Loan.

- Enter the Company name from whom the Loan has been acquired.

- Enter Loan Account No, Loan Amount, Interest Rate.

- Enter Loan Amount.

- Enter Interest Rate.

- Enter the Rate Type – the method of deducting Interest Rate.

- Enter Loan Start & Expiry Date.

- Enter the Tenure of the Loan.

- Now click on Ad Trx button and view the outcome.

Can I add/edit/delete the F&O, Commodity & Currency transactions?

No, you can not add/edit/.delete the F&O, Commodity & Currency transactions. However, all these types of transactionsre maintained through ANAND RATHI SHARE AND STOCK BROKERS LIMITED.

What are the details that I can see under the Net Worth Section?

Depending upon your login (Individual or Family head), net worth will offer you viewing option.

If you have logged in as a family head, you can access asset wise view or account wise view.

Under asset wise view you will be able to see the cumulative representation of the following details- Asset Class, the Investment Amount, the Current value, % of portfolio, Gain/Loss realized and unrealized.

Under Account wise view you will be able to see the following details for each of the Individual Account holders of the family.

The Investment Amount is a total of all open investments for a given Asset for which you have open positions.

The Current Value is the current market value of all your open positions in a given Asset

The percentage of the Current Portfolio defines your holding weightage across Assets.

Gain/Loss will give you details of realised and unrealised profits and losses across assets.

What are the assets covered in Net Worth?

Equity, F&O, Commodity, Currency, Mutual Funds, Fixed Deposits, Bullion, Cash In Hand, Insurance & Borrowing.

What does the chart represent?

The chart represents asset allocation in a 3 dimensional way. It gives you a break-up of your investments across asset classes ie equity & mutual funds and investment-wise ie scrip-wise and sector-wise.

How is Equity holdings presented?

By default you will see all your Long Positions (+ve) Holdings, which means equity investments where the balance quantity held by you is greater than 0. You can choose to view combined holdings or view only the –ve holdings through the options available on the page tool bar

The holdings can also be grouped on sectors to view holdings.

What are +ve /-ve and All Positions?

A +ve position is where the balance quantity is greater than 0 and a -ve position is where the balance quantity is less than 0. In case you wish to see both these positions together, they will be displayed under All Positions.

What will I be able to see in equity holdings?

You will be able to see the Scrip Name/ Company Name, the Hold Quantity, the Average hold Price, the Total hold value, the Current Market Price, the Current Market Value, % portfolio, Dividend and unrealized Gain/Loss.

What does the flag indicate on Security/Company?

Flag on Security/company indicates AR research calls - Board meeting.

How is the Hold Quantity computed?

The total number of shares outstanding for a given scrip/scheme is computed after taking into consideration all the balance number of shares outstanding after considering all reverse transactions.

What accounting standards are you following-FIFO or LIFO?

We are following the First In First Out (FIFO) accounting principle while calculating the balance quantity and capital gains. To understand further, refer to the following example.

How is MF holdings presented?

Now you can add your mutual fund investments in various schemes in your portfolio and track its performance. Here too, by default you will see all your +ve positions, which means investments where the balance quantity held by you in a given scheme is greater than 0.

What will I be able to see in the mutual funds holdings?

You will be able to see the scheme name, the scheme type, the balance quantity, the average purchase price, the initial investments, the dividend income, the current NAV, the current value and Gain/Loss.

The Scheme Type will give you the details whether it is a growth or a dividend scheme. The balance quantity reflects the outstanding units held by you in the said scheme.

The initial investment gives you the total outstanding investment in that given scheme.

The dividend income gives you a quick idea on how much dividend income you have earned on your dividend scheme.

The current NAV is the latest available net asset value for the given scheme in the database, which is largely the previous day's NAV

The current value is arrived at by multiplying the balance quantity x the current NAV.

The realised/unrealised gain and loss gives you a complete picture of the profit and loss position in a given scheme.

What is the dividend income on the mutual funds holdings page?

The dividend income gives you the details of the income earned from dividend and this will be computed only for dividend schemes.

My dividend income is showing 0 or is it wrongly computed?

In case you find that your dividend income is showing 0 or appears to be wrongly computed, click on the value which will give you details of the computation.

Also note that the dividend income is computed only at the end of the day. Hence, if you are editing, adding or deleting any dividend scheme transactions, the changes may not be reflected instantly. However, if you refresh your page, you will get your values displayed.

In case you find it wrong, write to feedback@rathi.com

How is the dividend income computed?

The dividend income takes into consideration the balance quantity held on the date of the dividend declared and it computes the dividend per unit to get the dividend income.

How are the mutual fund capital gains computed?

The mutual fund capital gains are computed on a FIFO basis. To understand this in details, refer to related questions in the help section of “What are capital gains and how are they computed?”

Can I download my investment holdings?

Yes, you can download your investment for open positions in an .xls format.

What will be shown in transaction history of Equity, F&O, Mutual fund & all other products?

It is a detailed listing of all transactions done for given scrip. It will list all your transactions date-wise with a summary of the current balance and realised gains/losses. You can edit your transactions.

You get a complete listing of all your transactions in given scrip / scheme. You can enter as many as transactions as you wish for a given scrip / scheme. Transactions are listed on the basis of transaction date. You get to see complete details such as Exchange on which you have bought Transaction price and Transaction quantity.

You also get current status as to what is the balance quantity of shares / scheme that you hold, its average purchase prices, current valuation and realized gain/loss.

What will be shown in transaction history of Fixed Deposit?

It will show Company name, FDR no, type of interest, interest rate, investment & maturity amount, investment & expiry date.

What will be shown in transaction history of Cash in Hand?

It will show your Ledger Balance with ANAND RATHI SHARE AND STOCK BROKERS LIMITED.

What will be shown in transaction history of Borrowing?

It will show the company from where the loan has been borrowed, the type of loan, the amount and interest rate of loan, the start and expiry date of loan.

What are capital gains?

When you sell any asset you own (house, land, shares, mutual fund units, gold, debentures, bonds) and you make a profit on the sale, it is known as capital gains. The tax you pay on this profit is called the capital gains tax. If you make a loss (you sell at a lower price than you bought an asset), you incur a capital loss.

What are the types of capital gains?

Depending on how long you have held the asset, the capital gains are classified either as short-term or long-term.

Short-term capital gains: If you sell the asset within 36 months from the date of purchase (12 months for shares or mutual funds), the gains are termed short-term capital gains.

Long-term capital gains: If you sell the asset after 36 months from the date of purchase (12 months for shares or mutual funds), the gains are termed long-term capital gains.

How are short-term capital gains taxed?

Very simple. Short-term capital gains are added to your total income. Depending on the tax bracket you fall under, you will be taxed.

How are long-term capital gains taxed on shares and mutual funds?

You can pay the tax on long-term capital gains on shares and mutual funds either at the rate of 20% or 10%. The choice is yours. This is how it is done. Let us say that Mr Mani purchased 4,000 shares on July 27, 2003 and paid Rs10 per share. He sold them on September 15, 2004 for Rs. 12 per share. Since the investment was held for more than 12 months, the capital gains will be long-term.

Note: Long term Capital Gain has been withdrawn w.e.f. FY2005-06. Which means no tax needs to be paid for long term investments

Has the capital gains calculation changed in the case of shares?

Yes. From October 1, 2004, if you sell your shares, equity mutual funds and balanced mutual funds, which have an equity component of 50% or more, the computation of tax differs. If you have short-term capital gains, the tax will be chargeable at 10%. Long-term capital gains are not taxed. On the flip side, no longer can you carry forward your long-term capital loss.

Capital loss? That's right. Sometimes, you do not make a profit. You sell at a higher rate than at what you bought. This is a capital loss. You can then set off this loss against your gains.~ Long-term capital losses can be set off only against long-term capital gains. ~ Short-term capital losses can be set off against any type of capital gains, long-term or short-term. You need not incur the loss and gain in one single year. A long-term capital loss can be carried forward for eight years to be set off against long-term capital gains. A short-term capital loss can be set off against any income under the head capital gains (whether short-term or long-term) and can also be carried forward for eight years. In both cases, these eight years start after the financial year when the loss is incurred.

Can I offset my Long term / Short term capital gain against my losses?

Yes you can offset your short term losses against short term gains and similarly long term losses against long term gains. Besides, you can carry forward both your short term and long term losses for 8 consecutive years. However these losses can be offset against its respective heads only

-

All about E-SIPs

What is E-SIP?

E-SIP or Equity Systematic Investment Plan is our new facility that enables to experience the advantage of growth potential in equity market, even for those who wish to invest a smaller amount. E-SIP basically allows you to place orders for a selected quantity in the desired scrips at pre determined intervals. For instance :- You can choose to buy E-SIP for a period of 9 months with a specified amount in a desired scrip or buy one share per month of the desired scrip. In order to place the orders you need to provide necessary details like name of the stock/scrip, amount / quantity to be invested, SIP (Systematic Investment Plan) or SWP (Systematic Withdrawal Plan) stock, frequency of investment and tenure (time period).

What is E-SWP?

Like E-SIP, E-SWP (Equity Systematic Withdrawal Plan) is a new service offered by AnandRathi. This service helps to sell your orders for selected amount or quantity in the desired scrips at regular intervals in the long run. Like E-SIP, E-SWP also requires above mentioned details to be filled.

Who can avail this facility?

All the existing and new clients can utilize the facility of E-SIP/SWP.

Why should I use E-SIP?

While investing in the cash segment you have to keep the track of market gains. E-SIP allows you to systematically invest a selected sum in a predefined tenure which makes the process very easy and organized. In simpler words you can invest without worrying about the right time in equity market. E-SIP reduces the cost of average acquisition of shares. You can now relax as you need not require to keep a active track of market, E-SIP aids in distributing your investment in the long run

How do I place E-SIP/SWP order through AnandRathi?

Placing orders through E-SIP/SWP is very simple.

- Login to trading portal (www.rathionline.com)

- Click on Equity → product offering → Equity SIP → Place Equity SIP

- Fill the Place E-SIP order from and click on submit.

Can I place Equity SIP Request for Sell transactions?

E-SIP allows the request to BUY orders while E-SWP allows the request to SELL orders.

Do I need to log in on every SIP date to place the Equity SIP orders?

Once the request for E-SIP is placed by you, Anand Rathi will release your E-SIP/SWP orders with respect to the exchange. There is no need for you to specially login to the account to sell or purchase stock.

What do you mean by Frequency? How does it work?

Frequency simply means time interval. The time when you placed order in SIP is taken as the start time and depending on that the total time period is calculated.

What is the minimum and maximum frequency?

Minimum frequency is 1 month while maximum frequency is 12 months.

What is E-SIP Order Book?

As the name suggests E-SIP Order Book is that page which displays details of your placed orders which includes SIP reference no., stock name, quantity or amount, frequency, total period, start date, next SIP date, end date etc.

What is "Quantity" based E-SIP?

One can choose quantity based investment option when he wishes to purchase fixed quantity of shares of a desired scrip at each frequency. The quantity is specified by you and is fixed during placing the orders at desired frequency. The order value would be calculated based on the market price of the scrip prevailing in the market at the time of order placement.

What is "Amount" based E-SIP?

One can choose amount based investment option when he wishes to invest a fixed amount in the desired scrip at each frequency. The amount specified by you should be equal or more than the last traded price of the desired scrip. While placing the order the quantity of amount will be calculated by dividing the E-SIP/SWP amount specified by you with the prevailing market price at the time when you placed the order.

Can I place E-SIP/SWP request in any scrip?

Yes, you can place E-SIP in any scrip, provided you have sufficient cash balance for SIP and holdings for SWP while placing the order.

What if E-SIP trigger day is holiday?

If your E-SIP trigger day is a holiday then the policy will trigger on the subsequent working day.

Can I modify or cancel E-SIP/SWP?

Yes, you can modify or cancel the current SIP/SWP by visiting E-SIP/SWP order book of your online trading account.

In which exchange do I place my order?

You can place your order in both NSE as well BSE

Should I place my E-SIP order only during market hours?

You can place your E-SIP request any time during the day which includes the post market hours too as the order triggers on the next working day.

When will my E-SIP/SWP orders hit the exchange?

Anand Rathi will release your E-SIP/SWP orders along with the post market orders however our administrator reserves the right to release the orders any time during the market hours.

What is the limit for E-SIP/SWP request?

One can place multiple E-SIP/SWP requests for different scrips in a day. However the request has to be placed separately for each script.

How will my Equity SIP/SWP transactions be settled?

E-SIP/SWP transactions are settled similarly as normal cash segment transactions.

Can I sell shares which I have bought through Equity SIP?

Yes you can, as E-SIP shares hold same value as that of cash segment shares. You can sell it through E-SWP or deal in shares through E-SIP any time as per your requirement.

What is Tr@de Mobi?

Tr@de Mobi is trading platform that provides you the facility to trade online using your Smartphone. It is a Mobile Trading Application that serves the investor clients with the comfort of trading on the move.

How to install it?

Installing Tr@de Mobi is very easy.Trade Mobi is available on both iPhones and Android based devices

- Visit your respective App store/Play Store

- Install the app on your device

- Enter your Login credentials and get started

(Note: Mobile User ID and password will remain same as the login details of your other Online Platforms)

How does it work?

Once Tr@de Mobi is installed and you start the application, the login screen appears. You have to enter your valid id and password which will take you to the trading platform.

For which mobile devices is Tr@de Mobi available? What versions?

Tr@de Mobi is available for iPhones and Android based devices. It requires iOS 7.1 and above.

App optimised for iPhone 5 and later versions. v5.0 and works well on Android 4.4 and above.

Is trade Mobi also available on blackberry devices? If yes, how to install the same?

Yes.

To install, follow the given steps:

- Visit https://m.anandrathi.com/download

- Download the Tr@de Mobi application

- Start the application once it is installed

- Enter your valid id and password on the login screen, which will take you to the trading platform

What can I do with Tr@de Mobi?

Tr@de Mobi allows you to carry out your entire online trading activities on mobile. You will be able to:

- Place Orders

- Modify, Cancel Orders

- View Order Book

- View Trade Book

- View Position Book

- View Limits

- View Quotes

- View Market Picture (MBP)

Note:

Note: